Mortgage refinance checklist: Everything you need to refinance your home [PDF]

When refinancing a home, you want to know your refinance goal, find the best lender and product to achieve it, and get your paperwork together to make it happen.

It’s easier than you think.

As long as you know what to expect and come prepared, you’re likely to find a solid refinance deal and save a bundle over the life of your loan.

In this article (Skip to. )

- Refinance checklist

- Should you refinance?

- Check your financials

- Gather your paperwork

- Shop around

- Apply for the loan

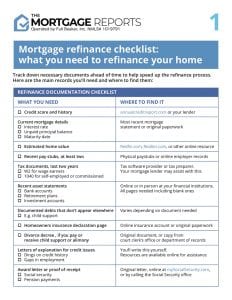

The Mortgage Reports downloadable refinance checklist

How to use this refinance checklist

Our mortgage refinance checklist covers most of the bases. Learn what’s involved, and how to prepare properly. Being ready can simplify the home buying process and provide greater peace of mind.

Preparation is vital for a mortgage refinance. You have to figure out if it makes financial sense, learn the facts, and shop around.

Getting your paperwork in order is crucial, too. Tackling these steps will save you time and worry.

Jon Meyer, The Mortgage Reports loan expert and licensed MLO, has a few extra tips to help you with your refinance checklist. He recommends:

- Bring pay stubs for the past (1) month at minimum, though lenders may ask to see more

- In terms of tax documents, have two years worth of W2s and tax returns ready, just in case. It’s better to have more documentation than less

- When you print or send your bank statements, you’ll need the past two months or the most recent quarterly statement. Make sure to include all pages, even if blank

- You don’t necessarily need to bring your own credit report or mortgage statement; the lender can typically request these for you. Though it may help to check them on your own first, as this will help you understand what rate and savings you should be in line for

Step 1: Should you refinance?

Is mortgage refinancing worth it? To help you decide, answer these questions:

- What will a refinance accomplish? Maybe you want to pay off your mortgage debt quicker. Or you may want to lower your monthly payment or drop private mortgage insurance. Perhaps you seek to tap into your home’s equity and pursue a cash-out refi to fund a home improvement project. Narrow down your goals.

- Can you cover refinance expenses? The closing costs and fees associated with refinancing a mortgage can often equate to 3% to 6% of your outstanding balance.

- How much longer do you plan to live in your home? “Before attempting a refi, you need to evaluate whether it will, in fact, save you money,” attorney Elizabeth A. Whitman says. She adds that a refi might be cost-prohibitive unless you plan to stay put for at least three years.

- Can you show consistent proof of income? And can you count on this source of income continuing for at least three years?

- If cash-out refinancing, is a cash-out refinance the best option? There are other loan options for borrowers who want to leverage their home equity, such as a home equity loan or a home equity line of credit (HELOC). Explore alternatives before setting on refinancing your existing mortgage.

- Will you be penalized for paying off my current mortgage? Some mortgage loans apply prepayment penalty fees. If yours does, find out how costly this can be.

Step 2: Check your financials

Now it’s time to do your homework. Complete these tasks.

Check your credit score and history

Mortgage lenders use your credit score to determine how likely you are to replay your new home loan. Higher credit scores generally fetch lower interest rates, which can save you thousands of dollars over the life of the loan.

You can obtain a free credit report through various online vendors, including annualcreditreport.com.

“Do this months before attempting a mortgage refinance. And correct any errors you see in your credit report long before applying,” says Whitman. “Even making small changes on your report can improve your credit score and result in a better interest rate.”

Many lenders require a minimum credit score of 620 to refinance a conventional loan. While there are no credit minimums set for FHA loans and VA loans, lenders will have their own criteria — so it’s important to shop your rate around to get the best deal.

Examine your most recent mortgage statement

Or find your original paperwork. Determine your current interest rate, unpaid principal balance, and maturity date. This will help you understand how much you stand to save on your refinanced loan, and what rate you need to achieve your goals

Learn what your home is worth

Use free online tools from Redfin, Realtor.com, and other sites that estimate your home’s current value.

Avoid applying for other lines of credit

In the months leading up to refinancing, be sure not to apply for additional lines of credit, such as personal loans and credit cards. “Too many credit inquiries can result in a reduction of your credit score,” says Whitman.

Step 3: Collect the documents needed to refinance your home

Before you can request and compare refinance loan offers, you need the right records in hand. Gather these documents.

- Proof of income: At minimum, one recent pay stub if you’re a wage-earner

- W-2 forms and tax returns from at least the last two years

- Recent asset or bank statements (for checking and savings accounts, retirement accounts and investment accounts) Note that you need all document pages, even if blank, and you need the most recent two monthly statements or most recent quarterly statement

- Document debts from student loans, credit cards, personal loans, and so on — as well as debts like child support that do not appear on your credit report

- Divorce decree: if you pay or receive child support or alimony payments

- Letters of explanation: for any dings in your credit history or gaps in your employment

- Award letter or proof of receipt of social security or pension payments

- Recorded deed showing the legal owners, along with your title insurance

- Homeowners insurance policy showing you have sufficient coverage

- Basic personal information including current address, and phone number

If providing printed documents, submit all pages, even the blank one at the back. If the first page says “1 of 4” on it, provide four pages.

Step 4: Shop around and ask questions

Compare mortgage rates and loan programs from several mortgage lenders (easy to do online). Then contact the most competitive lenders. Prepare to ask the following questions:

- Can you provide a Loan Estimate (LE)? “Review this estimate line by line to verify the true cost,” says Jacobson. “Review the rate, APR, closing fees and other important details,” says Jacobson

- How is your refinance loan better than my current home loan? “It rarely makes sense for a borrower to refinance unless the new mortgage rate is a noticeably lower interest rate than the existing one,” Whitman notes

- How much interest will you pay over the life of this loan versus what’s left on my existing mortgage loan?

- What are the closing costs and fees involved? Do you offer a “no-cost” refinance, which rolls these costs into the new home loan in the form of a slightly higher interest rate?

- What’s the maturity date on your loan amount? “Be cautious and consider long-term goals before extending your maturity date. For instance, consider a 58-year-old borrower with 10 years left on his mortgage. It might not make sense to refinance to a 30-year mortgage,” says Whitman. “Even though it may result in lower monthly mortgage payments, he could be paying this loan off well past retirement age.”

- Will the mortgage fully amortize (be paid off) during the loan term? Or will there be a balloon payment at the end? “Say it’s the latter, and you intend to remain in the home after the loan is paid off. Then, you’ll need to refinance again or have cash available to pay the balloon payment,” cautions Whitman

- Will there be a tax impact with refinancing? Most mortgage lenders tell you that it’s your responsibility to find this out, however

- Are the terms of this new loan subject to change in the future?

Step 5: Apply and make final preparations

Once you’ve narrowed down your list to a preferred lender, prepare for the following.

Complete the mortgage application

Most of the time, you’ll sit with or speak over the phone with your loan officer, broker or processor. They will fill out the mortgage application (Fannie Mae Form 1003), and you’ll sign the printed version (ask if it differs from the information you provided). “Also, read the details and anything you sign very carefully,” notes Jacobson.

Provide additional documents your mortgage lender requests

“And complete everything asked of you in a timely manner,” Jacobson says.

Stay in contact during the loan application process

“Find out who the loan officer is assigned to you. It’s important to have a point of contact between now and after closing,” adds Jacobson.

Prepare for the home appraisal

Most refinance loans require a new home appraisal to verify the home’s current value.

“Before they can underwrite the loan, your lender will order a home appraisal. You usually have to pay for this at the start of the process,” says Vincent Geraci, senior vice president and mortgage sales manager with Unity Bank.

However, there are some exceptions to the rule.

Streamline Refinance programs from the FHA, VA, and USDA, for instance, don’t require a new home appraisal. And qualified conforming loan borrowers might get an appraisal waiver from Fannie Mae or Freddie Mac in order to avoid this fee.

Respond quickly to additional requests

“Once approved, the underwriter may require additional documentation or conditions. This will be provided in the form of a list,” Geraci says.

“Once your appraisal and title are received and considered acceptable, and you have satisfied any other conditions, the underwriter will issue a clear to close. A closer will then reach out to you to schedule your closing.”

Get started on your refinance

Refinancing is not simple, but it doesn’t have to be overwhelming. And the benefits can be surprising.

Get started with your refinance goals using the link below. Today’s rates are low, so it’s the perfect time to get rate quotes to find your best deal.